What UK tech contractors need Spring Budget 2024 to deliver – boldness

Jeremy Hunt will unveil Spring Budget 2024 this Wednesday, when just about every tech freelancer running a limited company will hope for an overdue boost by this chancellor.

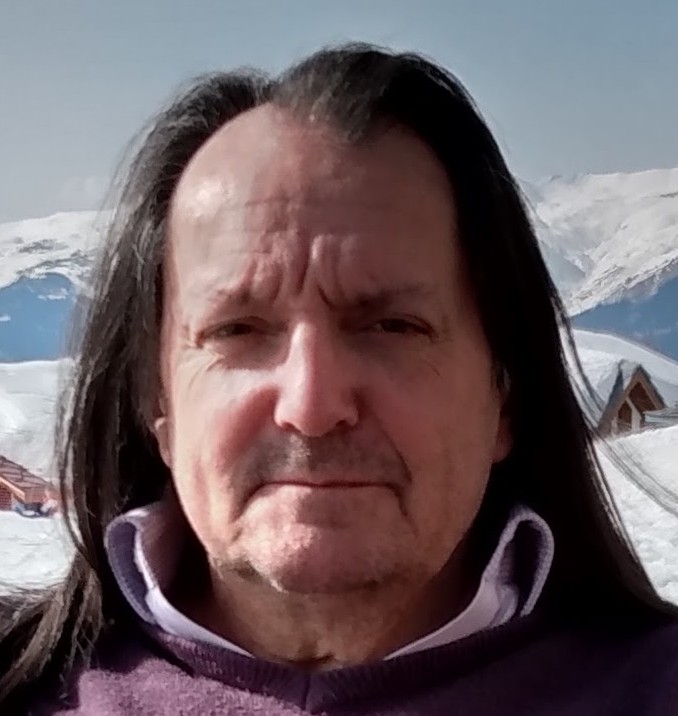

Let’s look at why, via the lens of tax, IR35 and dividends – all factors affecting such IT contractors’ take-home pay, writes chartered accountant Graham Jenner of Jenner & Co.

This chancellor hasn’t been bold. Maybe it’s due to his programming

Unfortunately Mr Hunt has, so far, not shown himself to be a ‘bold’ chancellor.

While this lack of boldness might be down to how he is programmed, it’s probably more to do with the chancellor being heavily influenced by the market’s reaction to his predecessor Kwasi Kwarteng’s 2022 ‘mini budget.’ The ‘Growth Plan’ which, while initially backed for axing IR35 reform (something IT contractors want Spring Budget 2024 to deliver) sent the UK into fiscal turmoil.

Two fiscal statements = not a lot for limited company IT contractors to cheer about

In the weeks that followed, Hunt gave us his first fiscal statement -- Autumn Statement 2022 which he called “a balanced plan for stability, a plan for growth and a plan for public services.”

As this rather sober, restrained description implies, there was nothing much in the statement for the average technology contractor – whether a Personal Service Company (aka a limited company) contractor, or an umbrella company employee.

A two pence NICs cut has helped techies who use umbrella companies

The most helpful measure of Hunt’s most recent statement -- Autum Statement 2023 (which followed his subdued Spring Budget 2023), was a 2% National Insurance cut for employees,.

This 2% NICs cut came into effect on January 6th 2024.

And this cut has been most beneficial to those IT workers contracting via an umbrella company. But is the chancellor now considering a further shaving of National Insurance on Wednesday?

Such an additional NICs reduction has been reported by The Times newspaper as incoming for this week’s Spring Budget, but whether it’ll be 1% or 2% cut remains to be seen.

Umbrella company contractors would, again, benefit the most from a further NI reduction by seeing the full saving enter their pocket.

Contractors and the tax-efficient salary-dividend mix…

Limited company contractors will be less enthused at the prospect of increasingly lower NI bills, as to pay themselves they tend to attract very little in national insurance due to adopting the low-salary, high-dividend mix for the purposes of tax-efficiency.

If you’re a limited company contractor and you don’t employ this mix, then reach out to me and I’ll advise how much you’re missing out on in take-home terms!

Hunt could hold back any NICs cut to just before you vote

With Wednesday’s fiscal statement possibly the last fiscal event before the general election, and the temptation to woo voters, Hunt may announce the anticipated NI reduction but then, strategically, hold back its introduction until just before the country goes to the polls.

Can IT contractors hope for something a bit more impactful, dare I say ‘bolder,’ than an NI-flavoured promise of jam tomorrow?

Speaking to Sky News at the weekend, Hunt played down any significant tax giveaways on Wednesday, which makes me think that he has secretly got a welcome announcement or two up his sleeve.

Whether it’s the boldness which limited company IT contractors are longing for, is unknown.

What about a corporation tax cut at Spring Budget 2024?

But unfortunately for such PSCs, I think a corporation tax cut is unlikely. With corporation tax having been increased only last year, a reduction could be politically dangerous for being branded a ‘U turn,’ so it’s unlikely.

N.B. Other than the UK, Turkey is the only European country to have put up taxes on company profits within the last year, seeming to call the chancellor’s decision -- which came into effect on April 1st 2023 -- into question.

To be bold chancellor, scrap the 1.25% additional dividend tax…

My plea to the chancellor, if he’s done the wise thing and become a Free-Work reader is this: scrap the additional dividend tax, which was introduced in April 2022 alongside the same percentage hike in additional Employee National Insurance. These tax increases were both intended to fund additional NHS spending at the end of the tortuous covid pandemic.

Chancellor Kwarteng scrapped this NI hike in September 2022, saying his getting rid of the hike was to reward the health sector’s staff for all their efforts during the pandemic. Hunt seemingly agreed as he did confirm the scrapping of the NI hike in an announcement once he replaced Kwarteng.

Inequity

But the current chancellor only made the take-back for employees; he left PSC directors suffering the additional 1.25 per cent. To me, and with covid now fortunately behind us, that seems unfair.

Put another way, if it was fair and proper to introduce this (in effect) NHS funding levy to be paid by staff and director/shareholders, then surely, when it’s time to scrap it, it should have been scrapped for both taxpayer categories?

Unfortunately, I fear the 1.25% additional dividend tax is now so entrenched, that the chancellor has forgotten all about it. And that’s despite Hunt himself having founded a company before he went into politics - Hotcourses, and despite him reportedly demonstrating an active awareness of dividends’ tax-efficiencies!

Bolder, still? Perhaps a Spring Budget incentive for companies to take on contractors

In recent years, we have seen no incentives whatsoever for UK organisations and commercial companies to hire contractors.

Quite the opposite in fact; there’s been a drip, drip, drip of measures that have the effect of discouraging ‘end-user’ businesses from using independent, skilled contractors and, therefore, discouraging the maturing of the flexible workforce.

So it would be refreshing to see something at Wednesday’s Spring Budget 2024 which encourages the taking on of contractors.

Could the scrapping of IR35 reform be the very rabbit out of the hat which, at the weekend, Hunt made out he doesn’t have the financial headroom to pull? Unfortunately I suspect the Off-Payroll Working rules aren’t going anywhere – any rabbit really is going to have to have wider appeal for fiscally-restrained Hunt to think it’s worth pulling!

An AI rabbit, with mass appeal? It gets my vote

I’ll leave it to the chancellor to choose its design, but some mechanism is needed to make risk-averse end-users nervous of HMRC liabilities under the OPW rules, confident enough to come forward once again and engage PSC contractors, so their operations can respond to peaks and troughs in demand.

The so-called ‘IR35 offset’ mechanism should help a little from April 6th 2024 when it is introduced, but it’s not necessarily going to be enough.

At a time when the UK needs to be driving the AI bandwagon, not just jumping on it, the UK is going to require a talented, nimble, freelance workforce to stay competitive and cutting-edge in this nascent but seminal technology field.

I've got a feeling that Jeremy Hunt knows this and is likely act, but for the avoidance of doubt:

My final appeal for Spring Budget 2024...

Chancellor -- let an Artificial Intelligence-related rabbit out of the hat be your one ‘bold’ moment of Spring Budget 2024. A corrective move, if you will, from the three overly cautious fiscal statements you’ve so far delivered, which neglected to stop the UK’s stagnant economic growth since early 2022 deteriorate into the ongoing recession which we fell into in the third and fourth quarters of 2023.

Graham Jenner is the managing director of Jenner Accountants Ltd and the Nopalaver Group. He qualified as a chartered accountant in 1972 and has been running his own accountancy practice, in Milton Keynes, since 1997. Having dealt with contractors for a number of years, he was one of the founders of the first Nopalaver company in 2006. He has overseen the growth of the group over the last 15 years which now provides a full range of services for contractors, agencies and end-clients. He regularly writes articles on ‘contractor’ related matters and provides advice to some of the largest temporary employment agencies in the world. His team includes four qualified accountants.

Comment

Log in or create your account to react to the article.